March 5, 2008

Tracking Stock Changes (de-listings, name changes, events, adjustments etc).

A list of unqualified data resources for tracking stock changes (de-listings, name changes, new issues, acquisitions, events, adjustments etc), with a bias toward the American market.

This is an unofficial resource guide. For a complete list of AmiBroker supported data providers refer to: http://www.amibroker.com/guide/h_quotes.html

The list is dynamic and subject to change without notice. It is ordered according to when the author researched the site and it is not sorted by rank or order of merit.

NOTE : MOST OF THE LINKS CONTAIN COMMERCIAL REFERENCES OR LINK TO COMMERCIAL SITES.

THE AUTHOR HAS NO COMMERCIAL AFFILIATIONS OF ANY KIND AND RECEIVES NO GRATUITIES, OR BENEFITS, FROM ANY COMMERCIAL ORGANIZATION OR INDIVIDUAL INVOLVED IN COMMERCIAL ACTIVITIES. NOR IS HE PERSONALLY ENGAGED IN ANY COMMERCIAL ACTIVITIES, RELATED TO TRADING, IN ANY WAY. THE LINKS ARE PROVIDED AS A RESOURCE AND FOR EDUCATIONAL PURPOSES. THEY ARE NOT A RECOMMENDATION, ON THE PART OF THE AUTHOR, NOR DO THEY CONSTITUTE INVESTMENT ADVICE AND SHOULD NOT BE CONSTRUED AS SUCH.

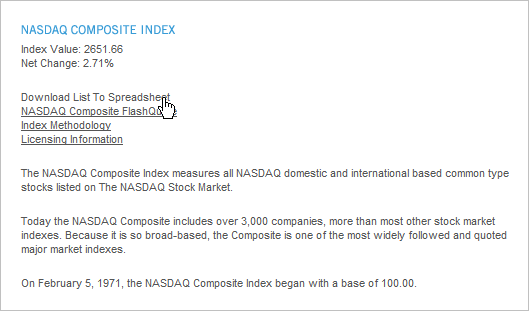

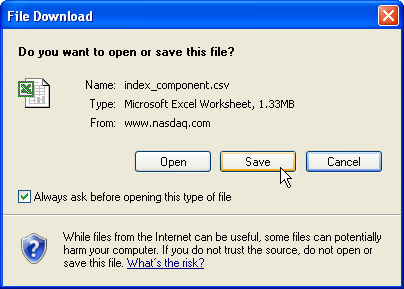

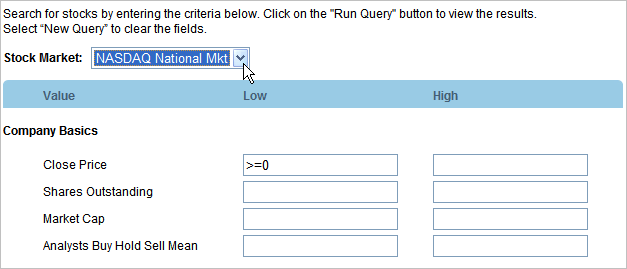

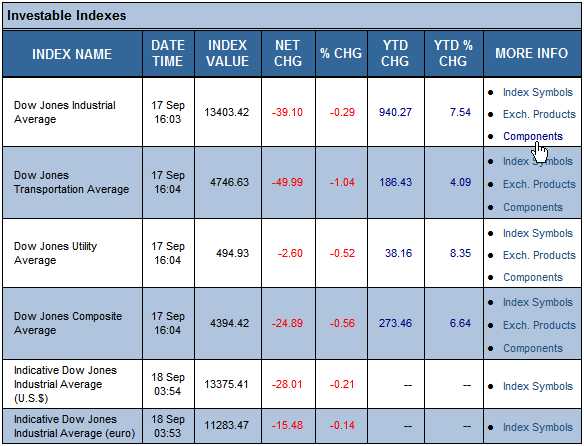

8) Nasdaq

A list of historical component changes to the Nasdaq 100 is available from the Nasdaq home site.

http://www.nasdaq.com/indexshares/historical_data.stm

7) Stockcharts.com

Stockcharts.com maintains a searchable list of "all recent IPOs, stock splits, distributions, and dividends".

http://stockcharts.com/charts/adjusthist.html

6) JustData (Australia, USA, London, International ?)

a) Historical Databases

Metastock format databases, that include delisted stocks, going back over 10 years for the Australian Securities Exchange (ASX), New York Stock Exchange (NYSE), London Stock Exchange (LSE) etc.

Note: the quality varies.

BodhiGold downloader allows user selected adjustments to equity data (limited to the ASX only?):

http://www.justdata.com.au/Training/Tutorials/Features/history_adjustments.htm

It also includes the option to display expired symbols, name changes, events, fundamental information, and new issues.

b) Back Office Data

"JustData, in co-operation with Exchange Data International (EDI) have made available numerous Worldwide products……….including data for over 100 exchanges and thousands of securities e.g. Corporate Actions, Adjustment Factors, Dividends, Dividend Re-investment Plans, Closing Prices, Codefile (covers all Traded, Coded and Defunct securities listed on the LSE Domestic & International Markets), Sedol Tracker (designed to track changes to the static securities database maintained by the London Stock Exchange. There are normally around 500 to 1000 changed records issued per day), Public Holidays, Depositary Receipts, Shares Outstanding, Security Reference File (provides up-to-date information on almost 450,000 securities, including all securities currently traded on the London Stock Exchange’s domestic and international markets)".

http://www.justdata.com.au/Corporate/Funds/fund_products.htm#actions

An example of an adjustment factor file, for the NYSE, is available here:

http://www.justdata.com.au/Corporate/Funds/images/events_nys.txt

5) Commodity Services Inc (USA)

http://www.csidata.com/ua/pricing/index.html

Historical equity databases for US, and non-US, equities and indices (mainly the London and Toronto exchanges).

Note: De-listed stocks are only available with annual subscriptions and at an additional fee.

4) OTC Bulletin Board (USA)

A list of new issues, symbol and name changes, and deleted issues for OTCBB securities is available from this page.

http://www.otcbb.com/dailylist/

3) Zacks Professional Services (USA)

Historical equity databases for survivor and non-survivor companies, including price and fundamental data.

Analyst estimate databases that ‘avoid’ look-ahead bias.

http://nt3.zacks.com/default.htm

2) deListed (Australia)

http://www.delisted.com.au/aboutus.aspx

This website is published by deListed, a division of BRG Pacific Pty Limited (ABN 64 003 142 372), holder of Australian Financial Services Licence No: 264673.

deListed provides updates and information on failed companies including those in external administration and companies suspended from ASX, NZX, NSX and BSX. It also has all historical name changes and delistings for these exchanges and carries administrators/liquidators declarations for Australian companies for tax purposes.

Background

deListed and this website delisted.com.au were established by BRG director, Tony McLean, in response to problems experienced by shareholders when their investments turned sour. Tony was the Australian Shareholders’ Association’s CEO for nine years until the end of 2001. In that role he often assisted angry and frustrated shareholders in delisted companies. Having seen their investment fail, these shareholders were then left in the dark about the fate of their companies. Company directors denied responsibility and could not be found. Shareholders did not know who was responsible. They were unable to establish if there was any chance of a recovery. It was difficult to track down external administrators. Shareholders often waited years for a liquidator’s declaration. (The issue of this declaration is a Capital Gains Tax Event enabling the crystallisation of a capital loss for tax purposes.) Many shareholders never received this declaration or knew that it had been issued. The eventual launching of this website on 1 September 2002 had its genesis in a commitment to a group of ASA members in 1998, following a spate of requests for information.

1) Norgate Investor Services (Australia)

For subscribers to Australian Securities Exchange (ASX) EOD data, "de-listed securities are moved from the main database and maintained in a ‘De-listed Securities’ folder……..Separate de-listed stocks to enable you to develop trading strategies across the entire universe of stocks including those that have been delisted (includes all delisted stocks back to 1992)".

Filed by brian_z at 7:23 am under Database Management Resources

Filed by brian_z at 7:23 am under Database Management Resources

Comments Off on Tracking Stock Changes (de-listings, name changes, events, adjustments etc).