March 6, 2008

Candle-Stick Evaluation (v2)

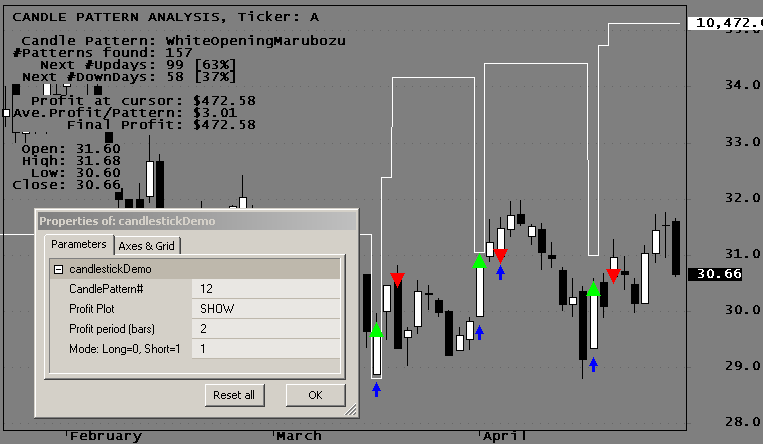

This indicator formula allows you to select Candlestick patterns, mark their occurrence on the chart, display their frequency, and test their predictive value. Apply the code to an Indicator, open up the Param window, and drag the CandlePattern# slider left and right to change to a different pattern. The selected pattern is identified in the chart Title text and graphically on your chart by a upwards pointing Blue arrow. The white line on your chart represents the resulting equity (“profit plot” in the Param window) for the pattern for the selected Profit Period. This line can be turned On or Off in the Param window. Entries (Buy or Short) are at the Close of the Pattern bar. Exits (Sell or Cover) are at the Open and can be delayed up to 10 bars with respect to the entry, as set in the Param window.

This code was originally written many years ago and was revised to take advantage of newer AFL functions. Also, code has been added to allow you to Backtest and Optimize to find the best pattern, delay, and trading mode. Note that trading mode “1” in the optimizer report indicates Long trades, a “0” indicates Short trades. Red Arrows are either Sell or Short, Green Arrows are either Buy or Cover, depending on your Mode selection. The chart below shows how typical CandlePatterns are identified:

Try different tickers; they will all behave differently. Only basic stats are provided in the chart Title, please add your own price patterns and metrics.

function ParamOptimize( description, defaultVal, minv, maxv, step ) { return Optimize( description, Param( description, defaultVal, minv, maxv, step ), minv, maxv, step ); } O1 = Ref(O,-1);O2 = Ref(O,-2); H1 = Ref(H,-1);H2 = Ref(H,-2); L1 = Ref(L,-1);L2 = Ref(L,-2); C1 = Ref(C,-1);C2 = Ref(C,-2); function CandlePattern(P) { global PatternName; if(P == 0) { PatternName = "NearDoji"; Pv = (abs(O-C)<= ((H-L)*0.1)); } else if(P == 1) { PatternName = "BlackCandle"; Pv = (O>C); } else if(P == 2) { PatternName = "LongBlackCandle"; Pv = (O>C AND (O-C)/(.001+H-L)>.6); } else if(P == 3) { PatternName = "SmallBlackCandle"; Pv = ((O>C) AND ((H-L)>(3*(O-C)))); } else if(P == 4) { PatternName = "WhiteCandle"; Pv = (C>O); } else if(P == 5) { PatternName = "LongWhiteCandle"; Pv = ((C>O) AND ((C-O)/(.001+H-L)>.6)); } else if(P == 6) { PatternName = "SmallWhiteCandle"; Pv = ((C>O) AND ((H-L)>(3*(C-O)))); } else if(P == 7) { PatternName = "BlackMaubozu"; Pv = (O>C AND H==O AND C==L); } else if(P == 8) { PatternName = "WhiteMaubozu"; Pv = (C>O AND H==C AND O==L); } else if(P == 9) { PatternName = "BlackClosingMarubozu"; Pv = (O>C AND C==L); } else if(P == 10) { PatternName = "WhiteClosingMarubozu"; Pv = (C>O AND C==H); } else if(P == 11) { PatternName = "BlackOpeningMarubozu"; Pv = (O>C AND O==H); } else if(P == 12) { PatternName = "WhiteOpeningMarubozu"; Pv = (C>O AND O==L); } else if(P == 13) { PatternName = "HangingMan"; Pv = (((H-L)>4*(O-C)) AND ((C-L)/(.001+H-L)>= 0.75) AND ((O-L)/(.001+H-L)>= 0.75)); } else if(P == 14) { PatternName = "Hammer"; Pv = (((H-L)>3*(O-C)) AND ((C-L)/(.001+H-L)>0.6) AND ((O-L)/(.001+H-L)>0.6)); } else if(P == 15) { PatternName = "InvertedHammer"; Pv = (((H-L)>3*(O-C)) AND ((H-C)/(.001+H-L)>0.6) AND ((H-O)/(.001+H-L)>0.6)); } else if(P == 16) { PatternName = "ShootingStar"; Pv = (((H-L)>4*(O-C)) AND ((H-C)/(.001+H-L)>= 0.75) AND ((H-O)/(.001+H-L)>= 0.75)); } else if(P == 17) { PatternName = "BlackSpinningTop"; Pv = ((O>C) AND ((H-L)>(3*(O-C))) AND (((H-O)/(.001+H-L))<.4) AND (((C-L)/(.001+H-L))<.4)); } else if(P == 18) { PatternName = "WhiteSpinningTop"; Pv = ((C>O) AND ((H-L)>(3*(C-O))) AND (((H-C)/(.001+H-L))<.4) AND (((O-L)/(.001+H-L))<.4)); } else if(P == 19) { PatternName = "BearishAbandonedBaby"; Pv = ((C1 == O1) AND (C2>O2) AND (O>C) AND (L1>H2) AND (L1>H)); } else if(P == 20) { PatternName = "BearishEveningDojiStar"; Pv = ((C2>O2) AND ((C2-O2)/(.001+H2-L2)>.6) AND (C2<O1) AND (C1>O1) AND ((H1-L1)>(3*(C1-O1))) AND (O>C) AND (O<O1)); } else if(P == 21) { PatternName = "DarkCloudCover"; Pv = (C1>O1 AND ((C1+O1)/2)>C AND O>C AND O>C1 AND C>O1 AND (O-C)/(.001+(H-L)>0.6)); } else if(P == 22) { PatternName = "BearishEngulfing"; Pv = ((C1>O1) AND (O>C) AND (O>= C1) AND (O1>= C) AND ((O-C)>(C1-O1))); } else if(P == 23) { PatternName = "ThreeOutsideDownPattern"; Pv = ((C2>O2) AND (O1>C1) AND (O1>= C2) AND (O2>= C1) AND ((O1-C1)>(C2-O2)) AND (O>C) AND (C<C1)); } else if(P == 24) { PatternName = "BullishAbandonedBaby"; Pv = ((C1 == O1) AND (O2>C2) AND (C>O) AND (L2>H1) AND (L>H1)); } else if(P == 25) { PatternName = "BullishMorningDojiStar"; Pv = ((O2>C2) AND ((O2-C2)/(.001+H2-L2)>.6) AND (C2>O1) AND (O1>C1) AND ((H1-L1)>(3*(C1-O1))) AND (C>O) AND (O>O1)); } else if(P == 26) { PatternName = "BullishEngulfing"; Pv = ((O1>C1) AND (C>O) AND (C>= O1) AND (C1>= O) AND ((C-O)>(O1-C1))); } else if(P == 27) { PatternName = "ThreeOutsideUpPattern"; Pv = ((O2>C2) AND (C1>O1) AND (C1>= O2) AND (C2>= O1) AND ((C1-O1)>(O2-C2)) AND (C>O) AND (C>C1)); } else if(P == 28) { PatternName = "BullishHarami"; Pv = ((O1>C1) AND (C>O) AND (C<= O1) AND (C1<= O) AND ((C-O)<(O1-C1))); } else if(P == 29) { PatternName = "ThreeInsideUpPattern"; Pv = ((O2>C2) AND (C1>O1) AND (C1<= O2) AND (C2<= O1) AND ((C1-O1)<(O2-C2)) AND (C>O) AND (C>C1) AND (O>O1)); } else if(P == 30) { PatternName = "PiercingLine"; Pv = ((C1<O1) AND (((O1+C1)/2)<C) AND (O<C) AND (O<C1) AND (C<O1) AND ((C-O)/(.001+(H-L))>0.6)); } else if(P == 31) { PatternName = "BearishHarami"; Pv = ((C1>O1) AND (O>C) AND (O<= C1) AND (O1<= C) AND ((O-C)<(C1-O1))); } else if(P == 32) { PatternName = "ThreeInsideDownPattern"; Pv = ((C2>O2) AND (O1>C1) AND (O1<= C2) AND (O2<= C1) AND ((O1-C1)<(C2-O2)) AND (O>C) AND (C<C1) AND (O<O1)); } else if(P == 33) { PatternName = "ThreeWhiteSoldiers"; Pv = (C>O*1.01) AND (C1>O1*1.01) AND (C2>O2*1.01) AND (C>C1) AND (C1>C2) AND (O<C1) AND (O>O1) AND (O1<C2) AND (O1>O2) AND (((H-C)/(H-L))<.2) AND (((H1-C1)/(H1-L1))<.2) AND (((H2-C2)/(H2-L2))<.2); } else if(P == 34) { PatternName = "DarkCloudCover"; Pv = (C1>O1*1.01) AND (O>C) AND (O>H1) AND (C>O1) AND (((C1+O1)/2)>C) AND (C>O1) AND (MA(C,13)-Ref(MA(C,13),-4)>0); } else if(P == 35) { PatternName = "ThreeBlackCrows"; Pv = (O>C*1.01) AND (O1>C1*1.01) AND (O2>C2*1.01) AND (C<C1) AND (C1<C2) AND (O>C1) AND (O<O1) AND (O1>C2) AND (O1<O2) AND (((C-L)/(H-L))<.2) AND (((C1-L1)/(H1-L1))<.2) AND (((C2-L2)/(H2-L2))<.2); } else if(P == 36) { PatternName = "doji"; Pv = (O == C); } else if(P == 37) { PatternName = "GapUp"; Pv = GapUp(); } else if(P == 38) { PatternName = "GapDown"; Pv = GapDown(); } else if(P == 39) { PatternName = "BigGapUp"; Pv = L>1.01*H1; } else if(P == 40) { PatternName = "BigGapDown"; Pv = H<0.99*L1; } else if(P == 41) { PatternName = "HugeGapUp"; Pv = L>1.02*H1; } else if(P == 42) { PatternName = "HugeGapDown"; Pv = H<0.98*L1; } else if(P == 43) { PatternName = "DoubleGapUp"; Pv = GapUp() AND Ref(GapUp(),-1); } else if(P == 44) { PatternName = "DoubleGapDown"; Pv = GapDown() AND Ref(GapDown(),-1); } return Pv; } SetTradeDelays(0,0,0,0); SetOption("AllowSameBarExit",False); P = ParamOptimize("CandlePattern#",20,0,44,1); PlotProfit = ParamToggle("Profit Plot","HIDE|SHOW",0); PP = paramOptimize("Profit period (bars)",1,1,10,1); CandlePatternTrue = CandlePattern(P); Mode = Paramoptimize("Mode: Long=0, Short=1",1,0,1,1); if ( Mode == 1 ) { Short = Cover = 0; Buy = CandlePatternTrue; BuyPrice = C; Sell = Ref( Buy, -PP ); SellPrice = O; } else { Buy = Sell = 0; Short = CandlePatternTrue; ShortPrice = C; Cover = Ref( Short, -PP ); CoverPrice = O; } E = Equity(1); Profit = E-GetOption("InitialEquity"); Upday = IIf(Ref(CandlePatternTrue,-1), C>O,0); downDay = IIf(Ref(CandlePatternTrue,-1), C<O,0); PatternColor= IIf(CandlePatternTrue,2,1); NumUpDays = LastValue(Cum(UpDay)); NumDownDays = LastValue(Cum(downDay)); NumPatterns = LastValue(Cum(CandlePatternTrue )); GraphXSpace = 10; Plot(C,"Close",colorBlack,64); if( PlotProfit ) Plot(E,"",2,styleStaircase|styleOwnScale); Pointer = IIf( CandlePatternTrue, 0.97*L,0); //PlotOHLC(0,0,Pointer ,0,"",6,styleCloud|styleNoLabel); PlotShapes( IIf(Pointer,shapeUpArrow,shapeNone),colorBlue,0,0.99*L,0); PlotShapes(IIf(Buy OR Cover,shapeUpTriangle,shapeNone),colorBrightGreen,0,C,0); PlotShapes(IIf(Sell OR Short,shapeDownTriangle,shapeNone),colorRed,0,O,0); Title = "\nCANDLE PATTERN ANALYSIS, Ticker: "+ Name()+"\n\n"+ " Candle Pattern: "+PatternName+"\n"+ "#Patterns found: "+NumToStr(NumPatterns ,1.0)+"\n"+ " Next #Updays: "+NumToStr(NumUpDays,1.0,False)+ " ["+NumToStr(Nz(NumUpDays/NumPatterns*100),1.0,False)+"%]\n"+ " Next #DownDays: "+NumToStr(NumDownDays,1.0,False)+ " ["+NumToStr(Nz(NumDownDays/numpatterns*100),1.0,False)+"%]\n\n"+ " Profit at cursor: $"+NumToStr(Profit,1.2)+"\n"+ "Ave.Profit/Pattern: $"+NumToStr(Nz(Profit/NumPatterns),1.2)+"\n"+ " Final Profit: $"+NumToStr(LastValue(Profit),1.2)+"\n\n"+ " Open: "+NumToStr(O,1.2)+"\n"+ " High: "+NumToStr(H,1.2)+"\n"+ " Low: "+NumToStr(L,1.2)+"\n"+ "Close: "+NumToStr(C,1.2);

Edited by Al Venosa.

Filed by Herman at 3:37 pm under Research and System Explorations

Filed by Herman at 3:37 pm under Research and System Explorations

Comments Off on Candle-Stick Evaluation (v2)