August 13, 2007

IO – Exhaustive Search .vs. Intelligent Algorithms

This page is obsolete. Current versions of AmiBroker feature built-in non-exhaustive, smart multithreaded optimizer and walk-forward engine.

The main factors involved in how much time optimizations take typically include:

. The Number of Combinations of Parameter Values

The AmiBroker engine is the fastest I’ve ever seen but even with very simple systems like a MACD or Stochastic utilizing 3 variables with potential values ranging from 1 to 100 it can take a long time using an exhaustive search process. The number of combinations for a simple system like this is 10 ^ 6 and even if our engine is capable of processing 100 combinations per second it will take close to 3 hours to complete the optimization process. Using the same fast AmiBroker engine to repeatedly perform small bursts of optimization with a few ( 15 – 50 ) combinations per burst and then intelligently redirecting optimization based on the results will typically perform a task like this in 5 – 10 minutes. For intelligent algorithms it makes little difference whether there are 3 variables to be optimized or 30 as this is not typically a factor that affects how long it takes them to solve problems. Robust solutions to engineering problems with hundreds of variables are typically solved by intelligent algorithms as these are the only methods feasible.

The benefits here are that not only do intelligent algorithms allow us to run common optimization problems much faster; they also allow us to solve problems that would not otherwise be possible.

· The Length of the Data Streams

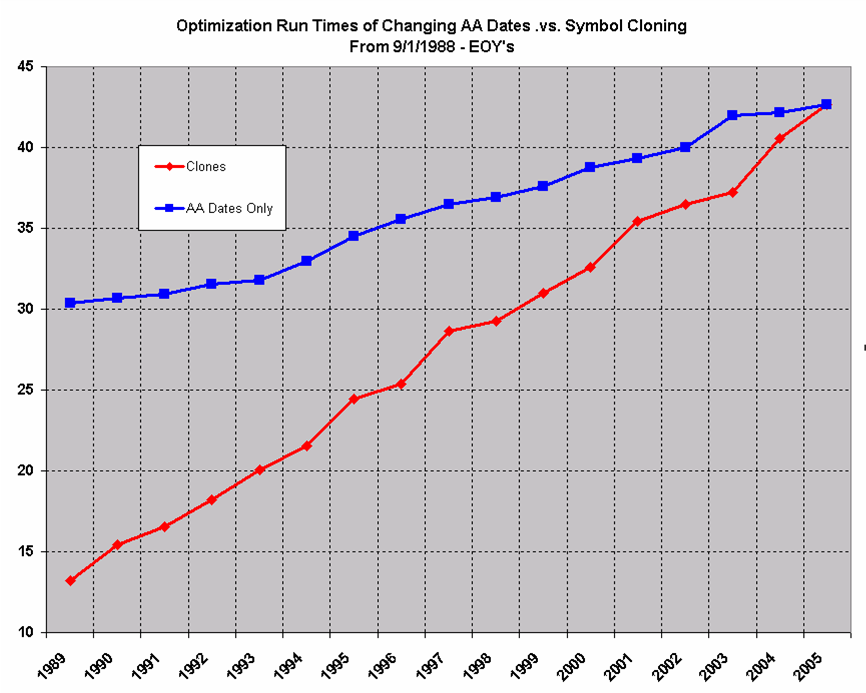

One of the things I have observed over the course of time is that there is a distinct difference of how long operations in AmiBroker take depending on the length of historical data loaded in AmiBroker. Changing the AA date range will have a minor effect on run times but we can have a much greater effect by cloning only the data needed from an existing symbol to a pseudo or cloned symbol and using the clone for optimization. As can be seen from the chart below, changing the AA dates to use only half the data results in a decrease of relative run times from 43 to 36 or about 16%. However, cloning the symbol with only half the data under a new symbol and using the clone for optimization results in a decrease of relative run times from 43 to ~25 or about 41%. That’s a 25% difference between the two methodologies.

While at first glance this would seem painful to utilize, if we have the means to automatically clone only the historical data needed then we can significantly reduce run times that much further. IO performs this function automatically.

· The Number of Data Streams

This includes the number Foreign symbols that are referenced as well as other issues like the length of Watch Lists etc. that are to be processed, neither of which we can have much affect on.

These are standard shareware features in IO.

A shareware version of IO with full documentation can be found in the AmiBroker Files Section …

http://groups.yahoo.com/group/amibroker/files/IO.zip

Filed by Fred at 5:49 am under Intelligent Optimization

Filed by Fred at 5:49 am under Intelligent Optimization

Comments Off on IO – Exhaustive Search .vs. Intelligent Algorithms