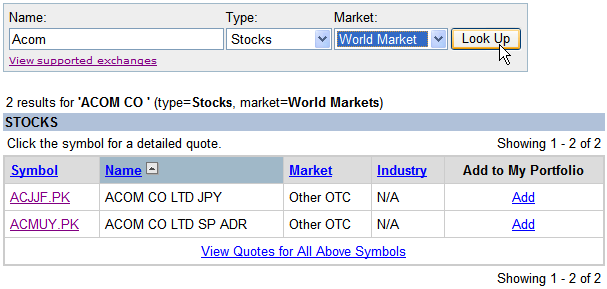

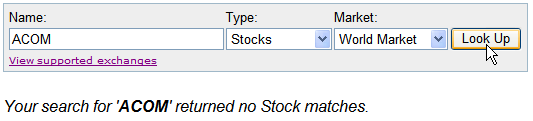

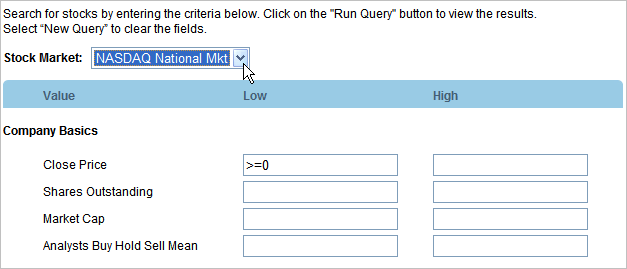

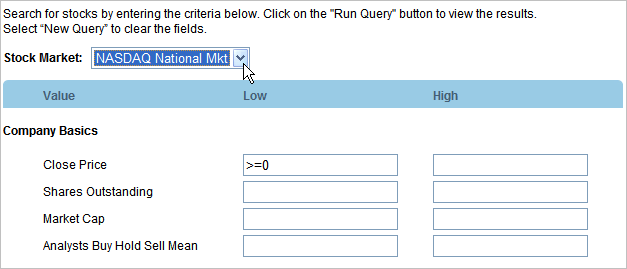

A stock screener that accesses an EDGAR Online database is available from the Nasdaq Exchange site.

http://www.nasdaq.com/

From the Homepage follow the Investor Tools >> Stock Screener link in the left hand sidebar to open the screener.

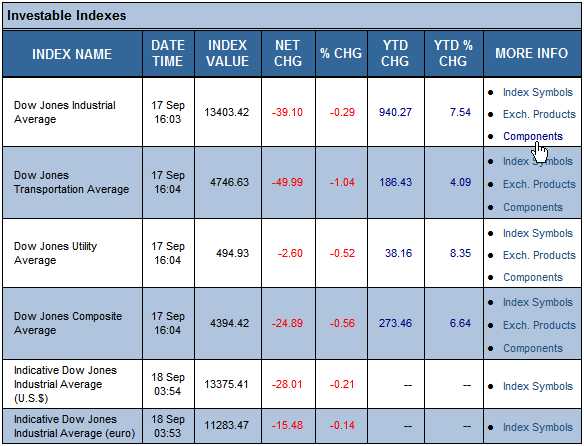

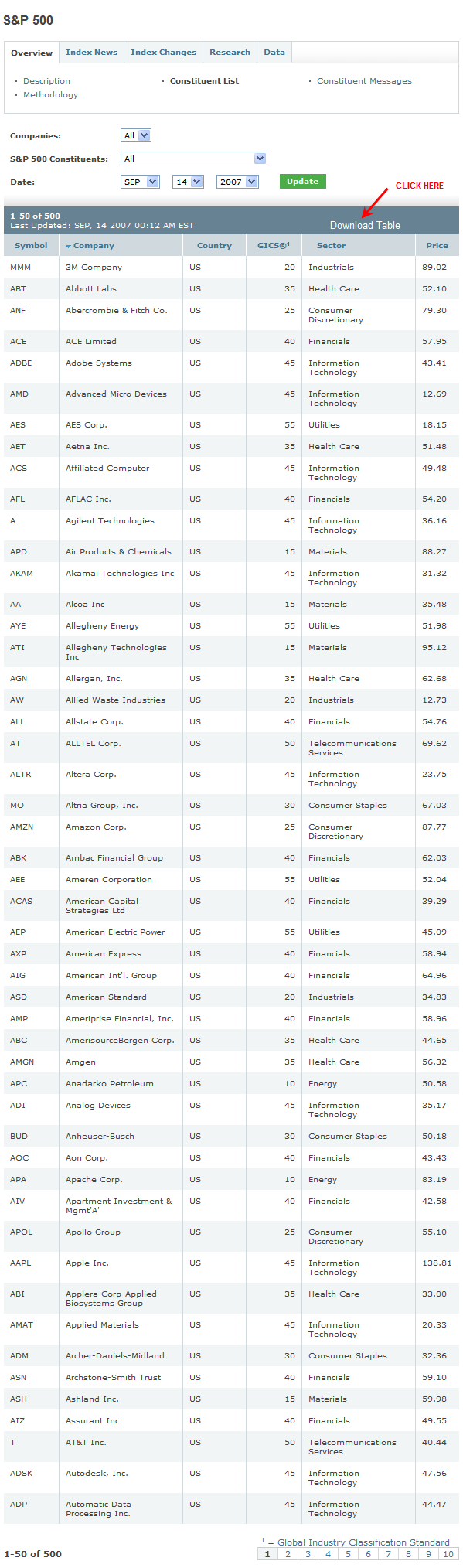

A list of constituents for several markets, including the Nasdaq National and Capital Markets, can be obtained by searching.

To create a National or Capital Market list:

1) Open the Nasdaq screener.

2) Select the required market from the Stock Market drop-down list, enter >=0 into the Close Price input box, as the search criteria, and run the screen by clicking on the Run Query button at the bottom of the page (leave all the other input boxes blank).

An HTML list of stocks will be returned by the search.

3) Select all stocks in the HTML list, right click inside the selected area and pick Copy form the context menu that opens.

Note: To select all of the HTML list position the cursor on the last letter in the right hand bottom corner (this starts the selection with text rather than a hyperlink), left click the mouse button and drag the cursor up and across to the left while holding the left mouse button down.

4) Enter the copied list into a blank Excel spreadsheet using Paste Special as Text.

5) Manipulate the data into the required format using Excels built-in functions.

The list can then be converted from Excel to an AmiBroker compliant format as required.

To convert an Excel list into an AmiBroker compliant format:

1) Click on the title at the head of a column e.g. "A" (or columns) to select the contents.

2) Right click inside the selected area and pick Copy from the context menu that opens.

3) Paste the copied list into a text file, using a program like Notepad, and save it for later use.

OR

1) Delete any additional Worksheets (ASCII import will only recognize one Worksheet in a Workbook).

Note: Where extra Worksheets contain valuable information make spare copies of the file first.

2) Delete any extraneous material in the lists e.g. comments, redundant columns or additional headers or footers.

Note: As a precaution copy any ‘wanted’ columns that have underlying formulas and Paste Special as Values first to ‘preserve’ the data i.e. change it to a permanent, independent format.

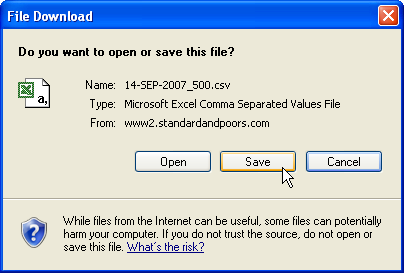

3) Save As a Comma Separated Values (CSV) file for later use (also known as Comma Delimited).

Note: When an Excel file, that contains one Worksheet, is saved as a CSV file the Worksheet will automatically be renamed to match the filename.

WARNING: ASCII IMPORT WILL STRIP ADDITIONAL WORKSHEETS FROM A WORKBOOK IF THEY ARE NOT MANUALLY REMOVED FIRST.

The attached file contains raw data and example formulas for changing the format of Nasdaq screened downloads (a basic knowledge of Excel and Excel’s functions is assumed).

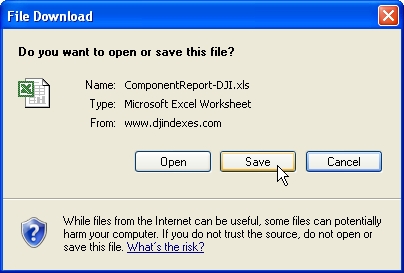

Right click on the attached file and Save Target As to download it to a local drive.

ATTACHED FILE:

Nasdaq screened list nasdaqmarketssept2007.xls

Written using Windows XPHome, Internet Explorer v7 and Excel 2002.

Filed by Herman at 12:49 pm under Indicators

Filed by Herman at 12:49 pm under Indicators