February 21, 2008

Data Adjustment – Yahoo

The objective of this post is to introduce readers to the basic concepts of data adjustment (how and when it is applied to historical equity data) using Yahoo data as the example.

Yahoo’s historical data is raw, unadjusted, data but Yahoo does maintain, and report, an adjustment factor to manage split events (stock splits and dividends).

To view historical data (using Caterpillar Inc [CAT] as the example):

1) Enter the symbol for any stock at the Y!Finance (US) site and select Get Quotes.

2) Click on Historical Prices in the Quotes section of the left hand menu bar and a download quotes page will open (the default view is the most recent 1 -2 months of prices).

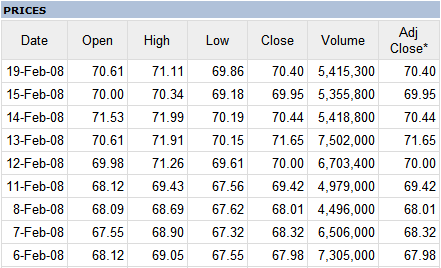

The adjustment factor is reported, with the raw data, as Adjusted Close (AdjClose).

For the current records the adjusted AdjClose and the raw Close are the same.

Note: The records are listed from bottom to top with the most recent at the top.

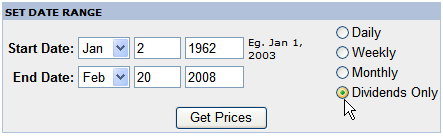

The recent dividend and split history is available.

To view the events record pick the Dividends Only radio button in the SET DATE RANGE panel and click on Get Prices.

A record of dividends and splits, that go as far back as the historical data itself, will open.

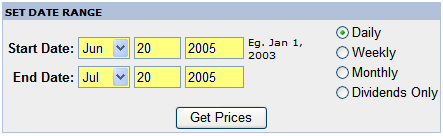

To check how the adjustment has been applied, for any specific split event e.g. the 14-July-05 stock split, set the date range and Get Prices to match.

Only data within the date range specified will be downloaded.

The data can be downloaded to a spreadsheet, if required, by clicking on the Download To Spreadsheet link at the bottom of the table.

Adjustment Methodology

Yahoo adjusts the close (factor) based on the standards laid down by the Center For Research In Security Prices: http://www.crsp.com/

The guidelines can be found by searching the site using "dividend adjustment", as the criteria, or by going to the Data Description Guide (an extract from the document is attached to the end of this post).

By default, AmiBroker downloads the AdjClose and calculates the adjusted OHL ‘on the fly’, using the adjustment factor i.e. AdjClose/Close.

For additional discussion on adjustment and an explanation of how AmiQuote calculates the OHL values refer to:

YahooAmiBrokerGroup message: http://finance.groups.yahoo.com/group/amibroker/message/93631

AmiBroker Knowledge Base article: http://www.amibroker.com/kb/2007/08/04/amiquote-and-free-data-from-yahoo/

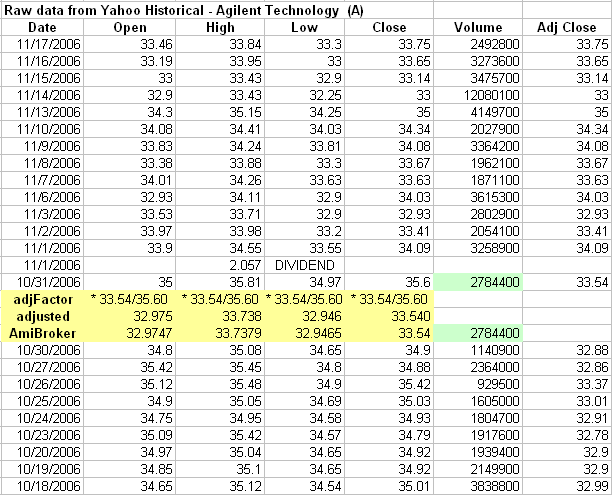

Example 1 – Agilent Technology (A) dividend:

In this example, the dividend on the 1st November, 2006 , is the first split event in recent history i.e. on 2/21/2008, the date of this post, (the Close and the Adj Close are the same up until the first ex dividend day).

For the dates preceding the split, the raw prices are adjusted by Amiquote during the download process (the adjustments, for 10/31/2006, are marked in yellow).

Note: the volume (marked in green) is not adjusted.

The adjustment factor, prior to the split date, is a constant = = AdjClose/Close.

The AdjFactor, at the dividend date = = (Close – dividend)/Close = = (35.60 – 2.057)/35.60 = = 33.54/35.60 = = 0.94

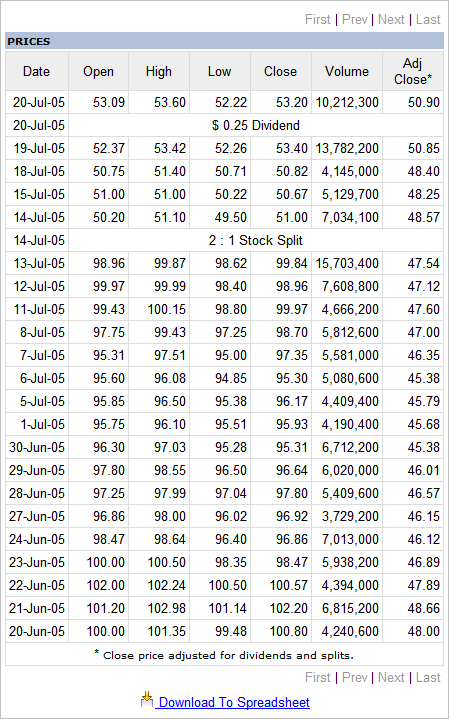

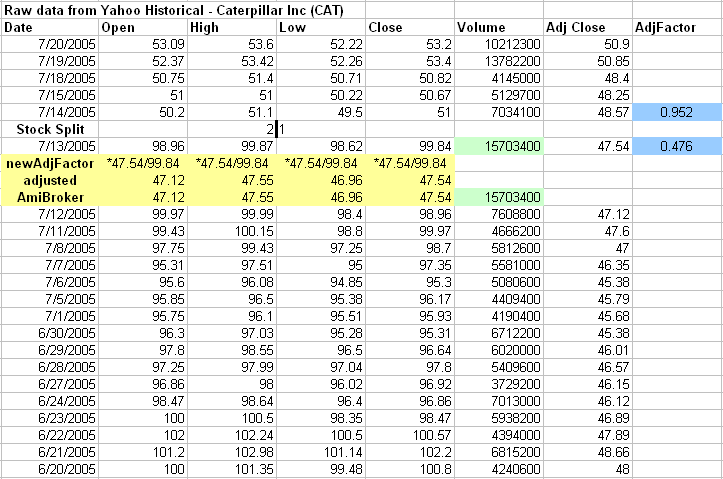

example 2 – Caterpillar Inc (CAT) 2:1 split:

In this case the split is deep in the history and prior adjustments have been made for other split events i.e. the AdjClose and the Close are different prior to the split of 7/14/2005 (refer to the attached CRSP extract that contains information on compound adjustment factors).

Note: As before the Volume, marked in green, is not adjusted. The adjustment factor prior to the split, marked in blue, is halved on the split date.

ATTACHED FILE:

An extract from a Center For Research In Security Prices (CRSP) guide that details some adjustment methodologies and formulas – CRSP Dividend Adjustment (extract)

Filed by brian_z at 12:15 am under Data

Filed by brian_z at 12:15 am under Data

Comments Off on Data Adjustment – Yahoo